UKGC Bans Credit Cards as of April 2020

The UK Gambling Commission (UKGC) has banned credit cards as a payment method for all gambling. The ban will come into effect in April 2020.

The UKGC ban on credit cards is is the latest development in regulations to foster responsible gambling in the United Kingdom. Given the initiatives that the commission has implemented in recent months, it is more than certain that more regulations will come into place in the course of the year.

“The ban, which will apply to all online and offline gambling products with the exception of non-remote lotteries, will provide a significant layer of additional protection to vulnerable people” (UKGC)

The UKGC made the decision following its latest 2019 review of online gambling and the UK Government’s Review of Gaming Machines and Social Responsibility Measures.

24 million adults in the UK gamble and an estimated 22% could be considered problem gamblers.

UKGC bans credit cards for gambling out of concern for players

It’s estimated that 24 million adults in Great Britain gamble, with almost 44% (10.5 million) gambling online. According to research by UK Finance, an estimated 800,000 used credit cards for gambling in 2018, including online gambling.

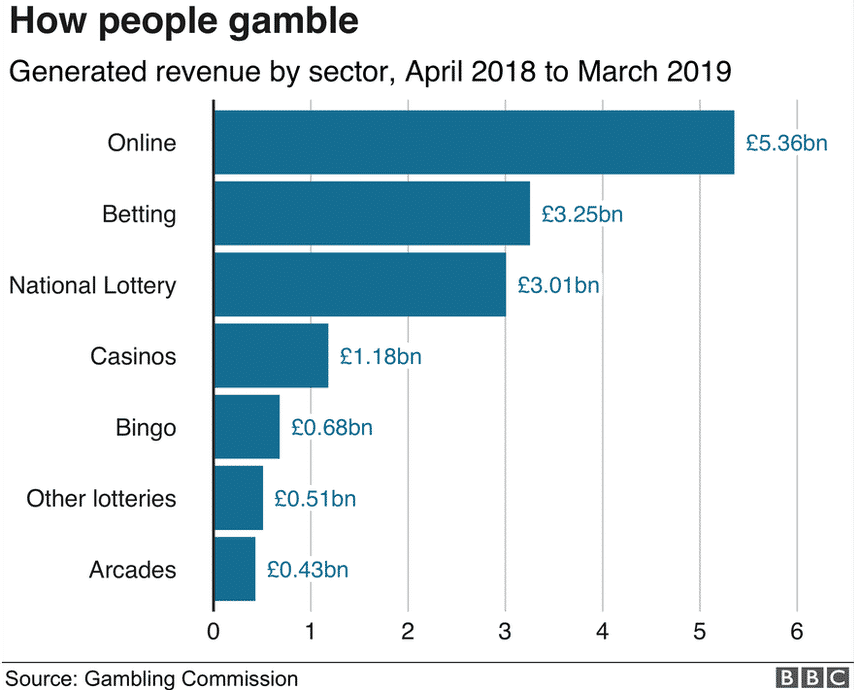

This graph by the BBC shows gambling revenue generated by sectors in the UK:

Online research carried out in March 2019 by Populus for the UKGC measured a sample population of around 2000 adults and concluded that 22% of them could be classed as “problem gamblers”.

This ban is part of a broader initiative that saw several measures introduced over the last year, including a reduction to maximum stakes on fixed odds betting terminals, an increase on identity checks and age verifications for online gambling, and an expansion of professional support provided through the National Health Service (NHS).

Online gambling websites licensed in the UK are also required to register at Gamstop, as an effort to help people opt out of gambling. Other measures include affordability checks for players, and setting up limits within online casino accounts to restrict player spending and playtime. These measures seek to help prevent gambling problems before they arise, and to manage the behaviour of individuals who might consider themselves problem gamblers or potential problem gamblers.

Online gambling generated £5.36bn between April 2018 and March 2019

Risk of harm outweighs convenience

The UK Gambling Commission’s chief executive, Neil McArthur, said that the risk of harm posed by credit card use to vulnerable individuals outweighed the convenience that credit cards provide to consumers who are not at risk.

“We will evaluate the ban and watch closely for any unintended circumstances for consumers” (Neil McArthur, UKGC chief executive)

Businesses that sell gambling products, from lottery vendors to online casinos, must stop accepting credit card payments as of 14 April 2020.

Responsible gambling

We at LadyLucks take responsible gambling and problem gambling very seriously, and you can read our full article on the subject by clicking here. The article includes a list of resources that players can use to self-assess their gambling behaviours, as well as contact information for counselling and help centres.

What’s important is that you remember that gambling addiction is a serious issue, and that while some people can gamble online and have fun, others struggle with compulsive gambling. It’s important that you know yourself and your habits.

Never be afraid to talk to your friends and loved ones and reach out for help if you feel you can’t control your gambling behaviour. One of the main reasons why compulsive gambling gets out of hand is that individuals often experience feelings of shame and embarrassment, which delays or prevents them from reaching out to their friends and family. If you or someone you know is struggling with gambling addiction, don’t hesitate to seek help.

“We will not hesitate to take any further action necessary to protect people from gambling harm.” (Helen Whately, Culture Minister)

Gambling addiction is recognised as a mental health illness that causes players to become excessively devoted to playing games for real money and chasing the fantasy of winning and the physical sensations that come with it, such as adrenaline rushes. This causes people to stop paying attention to fundamental needs, like paying bills, nurturing relationships, performing at work and school, and many more. In the long term, this can lead to alienation and self-destructive behaviour that can result in financial problems for the person and their loved ones.

There are many common symptoms that can manifest themselves in isolation or in different combinations, including isolation, depression, secretiveness, lying, borrowing money and many others. It is precisely to prevent people from incurring unnecessary gambling debts that the UKGC bans credit cards.

There are several organisations and support groups that specialise in treating compulsive gambling through counselling and support. GamCare runs the National Gambling Helpline (0808 8020 133) and Gamblers Anonymous UK offers a 12-step programme for recovery. There are also NHS specialist clinics for players aged 16 and over in England and Wales.

Leave a Reply